Retirement

Enjoying life comfortably.

In retirement it is more important than ever to make the right financial decisions.

For most people, the major concern is simple: how can I make my money last, while enjoying the lifestyle I desire? With the average retirement period being 30 years, it’s a good question to ask.

Most people think the answer is good investments. But that’s only part of it. To build or preserve your retirement lifestyle, you will also need to address the following issues:

- What type of lifestyle do I want?

- What goals matter most to me?

- How can I get the most income?

- What are my Centrelink entitlements, if any?

The good news: You can be a winner in retirement. Together with quality financial advice from GPA Financial Services, you can explore the possibilities, avoid expensive mistakes and make the right choices.

Ongoing Review and Management

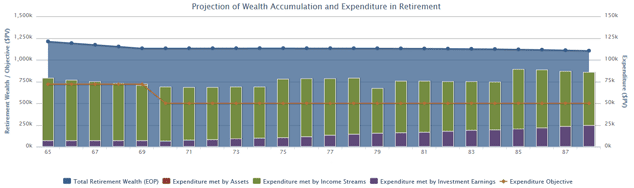

We believe that one thing is certain, change. After implementing appropriate strategies, it is most important that you manage your personal cash flow to be prepared for any unexpected expenses or increased living costs. Our planning meetings review your income producing assets and any potential dangers of running down or running out of money. The results of these meetings are shown in easy to follow graphs. For the more analytical all the numbers can be seen in detailed spreadsheets as well.

Menu

Menu